Eliminate Taxes on Your IRA Without Paying Out Of Pocket

If you could eliminate taxes on your IRA, without paying the taxes out of your pocket, why wouldn’t you do it?

Eliminate Taxes on Your IRA Without Paying Out Of Pocket

If you could eliminate taxes on your IRA, without paying the taxes out of your pocket, why wouldn’t you do it?

Eliminate Taxes on Your IRA Without Paying Out Of Pocket

If you could eliminate taxes on your IRA, without paying the taxes out of your pocket, why wouldn’t you do it?

This Proprietary Strategy allows you to legally and ethically disinherit the Internal Revenue Service

- Remove the risk that future tax hikes will have on your retirement income

- Retain control of your money for your family, forever!

- Settle your tax bill before it increases

- Remove the Internal Revenue Service control from your IRA

- Eliminate all RMD’s on your account

This Proprietary Strategy allows you to legally and ethically disinherit the Internal Revenue Service

- Remove the risk that future tax hikes will have on your retirement income

- Retain control of your money for your family, forever!

- Settle your tax bill before it increases

- Remove the Internal Revenue Service control from your IRA

- Eliminate all RMD’s on your account

This Proprietary Strategy allows you to legally and ethically disinherit the Internal Revenue Service

- Remove the risk that future tax hikes will have on your retirement income

- Retain control of your money for your family, forever!

- Settle your tax bill before it increases

- Remove the Internal Revenue Service control from your IRA

- Eliminate all RMD’s on your account

Learn How To Use This Proprietary Strategy To

Fund Your Optimal Retirement.

Tax-Free Retirement Income

Once implemented, our strategy allows you access to your money with no taxes due. Did you know that your IRA and 401(k) are controlled by the IRS because none of the money has ever been taxed?

The amount of spendable money per dollar withdrawn is subject to full taxation, thus, your spendable income can be significantly reduced with future tax hikes.

Your Principal Is Guaranteed

Never lose your money to stock market crashes and poor stock selection.

Legendary Investor Warren Buffet says “Rule No.1: Never lose money.”

“Rule No.2: Never forget rule No.1.”

Our strategy will not only protect your principal but give you the opportunity for growth.

Tax-Free Benefits For Your Family

Not only does our strategy allow for your use of capital without being taxed, but the remaining balance in your account shall pass to your beneficiaries free of tax as well.

When structured properly, your account can provide tax-free benefits for your family for generations to come, just like the Rockefellers.

Learn How To Use This Proprietary Strategy To

Fund Your Optimal Retirement.

Tax-Free Retirement Income

Once implemented, our strategy allows you access to your money with no taxes due. Did you know that your IRA and 401(k) are controlled by the IRS because none of the money has ever been taxed?

The amount of spendable money per dollar withdrawn is subject to full taxation, thus, your spendable income can be significantly reduced with future tax hikes.

Your Principal Is Guaranteed

Never lose your money to stock market crashes and poor stock selection.

Legendary Investor Warren Buffet says “Rule No.1: Never lose money.”

“Rule No.2: Never forget rule No.1.”

Our strategy will not only protect your principal but give you the opportunity for growth.

Tax-Free Benefits For Your Family

Not only does our strategy allow for your use of capital without being taxed, but the remaining balance in your account shall pass to your beneficiaries free of tax as well.

When structured properly, your account can provide tax-free benefits for your family for generations to come, just like the Rockefellers.

Our team of experts provide continual optimizations for cutting-edge performance.

We mathematically and scientifically optimize the tools used to produce the outcome you desire, maximum tax-free retirement income.

Don’t Leave Your Retirement Optimization In The Hands Of Amateurs!

Our team of experts provide continual optimizations for cutting-edge performance.

We mathematically and scientifically optimize the tools used to produce the outcome you desire, maximum tax-free retirement income.

To design for optimal results, you need to begin with the end in mind.

If you want the greatest gas mileage for a car, you need to make all the design choices to meet that goal. Would that vehicle be able to pull a heavy trailer? Of course not!

But even if you had the car with the greatest gas mileage…

…would you personally achieve that gas mileage over time? Quite possibly not.

Why?

Because of your driving habits! You drive too fast, and you brake too hard. Heck, you might even have your air conditioning on and your cell phone charger plugged in.

All these things detract from your optimal gas mileage!

But even if you had the car with the greatest gas mileage…

…would you personally achieve that gas mileage over time? Quite possibly not.

Why?

Because of your driving habits! You drive too fast, and you brake too hard. Heck, you might even have your air conditioning on and your cell phone charger plugged in.

All these things detract from your optimal gas mileage!

To get the optimal output, you need the right vehicle for the job.

You also need the appropriate driver to operate the vehicle with the right standards to achieve the optimal output.

Our strategy takes the goal you have and designs the specific outcome based on an unbiased use of market-available solutions.

We then optimize those solutions with all available resources to get the greatest mathematical and scientific outcome for your retirement.

Finally, our team of experts make sure you are operating your strategy through an ongoing service agreement that is included with your plan.

To get the optimal output, you need the right vehicle for the job.

You also need the appropriate driver to operate the vehicle with the right standards to achieve the optimal output.

Our strategy takes the goal you have and designs the specific outcome based on an unbiased use of market-available solutions.

We then optimize those solutions with all available resources to get the greatest mathematical and scientific outcome for your retirement.

Finally, our team of experts make sure you are operating your strategy through an ongoing service agreement that is included with your plan.

So What Are You Going To Get?

You’re going to what you need to get the maximum mileage!

If we could get the right car, the right driver, the right accessories, and use them optimally, would we be able to mathematically and scientifically beat the gas mileage of all competitors?

YES, of course we would!

It’s The Same With Your Retirement Money!

You need to use the right solution to get the maximum results.

Take Gains, Not Losses

Participate In Market Gains With No Losses To Suffer From.

You Remain In Control Of Your Money

Eliminate The Government and IRS From Controlling Your Retirement Assets.

Take Gains, Not Losses

Participate In Market Gains With No Losses To Suffer From.

You Remain In Control Of Your Money

Eliminate The Government and IRS From Controlling Your Retirement Assets.

Our proprietary strategy allows you to make $1 do the work of $2 at the same time!

Our plan allows you to take control of your finances, retirement, and legacy. You can rig the game in your favor (just like the wealthy have been doing for years.)

Live the abundant lifestyle that you and your family deserve, without the interference of the government or Internal Revenue Service.

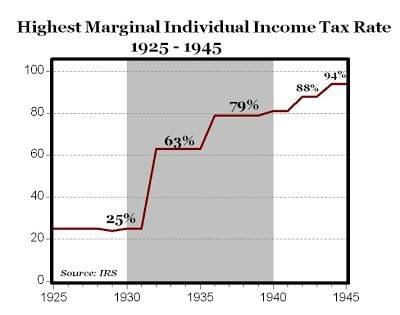

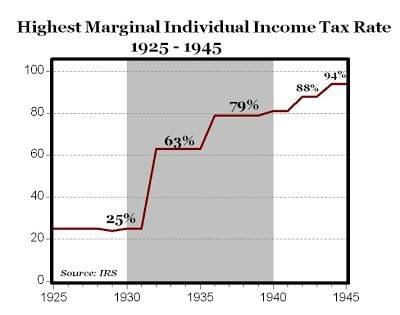

Are taxes really something to worry about?

When the Government is short on capital, like they were during the Great Depression and the World Wars, they raised taxes dramatically.

It could happen again.

The current U.S. debt is over $28 trillion! In the next 4 years, that amount will climb to over $30 trillion… Are you ready?

Are taxes really something to worry about?

When the Government is short on capital, like they were during the Great Depression and the World Wars, they raised taxes dramatically.

It could happen again.

The current U.S. debt is over $28 trillion! In the next 4 years, that amount will climb to over $30 trillion… Are you ready?

Even people in the lowest tax brackets could see their taxes dramatically increase like they have before!

Don’t be fooled into thinking that tax hikes will only affect the rich. It never works out that way.

Create Tax-Free

Retirement Income.

It’s Common Sense!

Math and science will prove to you that money kept in 401(k) and IRA accounts is inefficient and may jeopardize your secure retirement when future tax increases arrive.

You simply have no control of how much money the government will take from your IRA when they need it!

Create Tax-Free

Retirement Income.

It’s Common Sense!

Math and science will prove to you that money kept in 401(k) and IRA accounts is inefficient and may jeopardize your secure retirement when future tax increases arrive.

You simply have no control of how much money the government will take from your IRA when they need it!

Create Tax-Free Retirement Income.

It’s Common Sense!

Math and science will prove to you that money kept in 401(k) and IRA accounts is inefficient and may jeopardize your secure retirement when future tax increases arrive.

You simply have no control of how much money the government will take from your IRA when they need it!

You’re only one phone call away…

Take control of your retirement assets and eliminate the IRS and Government from your life now and forever!

Melody

Wilder

Melody Wilder

You’re only one phone call away…

Take control of your retirement assets and eliminate the IRS and Government from your life now and forever!

Melody Wilder

You’re only one phone call away…

Take control of your retirement assets and eliminate the IRS and Government from your life now and forever!